The oil & gas industry continues to be a hotbed of patent innovation. Activity is driven by digitalization, analytics, and cybersecurity, and growing importance of technologies such as wearable technologies, IP cameras, and advanced analytics. In the last three years alone, there have been over 523,000 patents filed and granted in the oil & gas industry, according to GlobalData’s report on Internet of Things in oil & gas: worksite network monitoring. Buy the report here.

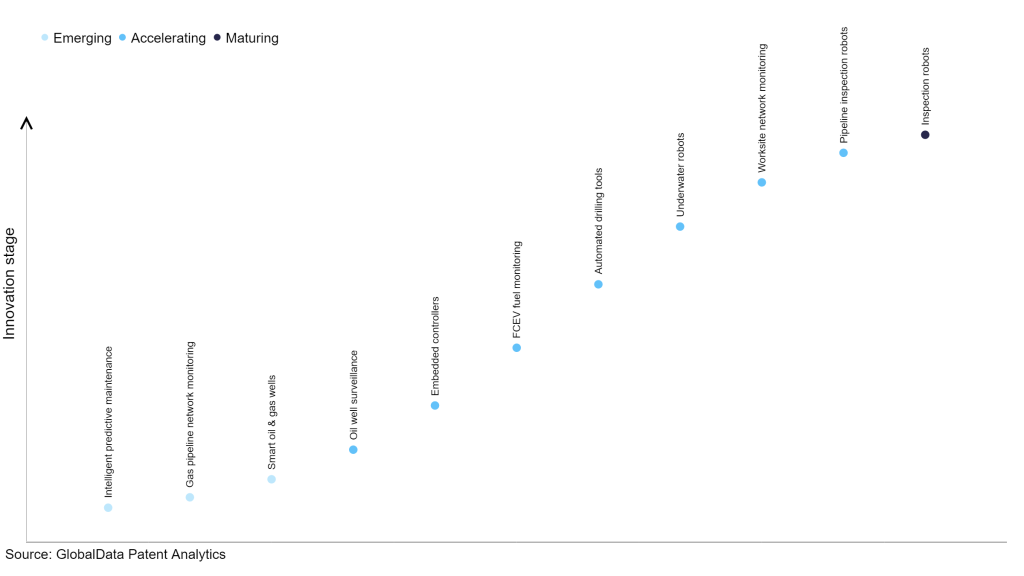

However, not all innovations are equal and nor do they follow a constant upward trend. Instead, their evolution takes the form of an S-shaped curve that reflects their typical lifecycle from early emergence to accelerating adoption, before finally stabilizing and reaching maturity.

Identifying where a particular innovation is on this journey, especially those that are in the emerging and accelerating stages, is essential for understanding their current level of adoption and the likely future trajectory and impact they will have.

60+ innovations will shape the oil & gas industry

According to GlobalData’s Technology Foresights, which plots the S-curve for the oil & gas industry using innovation intensity models built on over 196,000 patents, there are 60+ innovation areas that will shape the future of the industry.

Within the emerging innovation stage, intelligent predictive maintenance, gas pipeline network monitoring, and smart oil & gas wells are disruptive technologies that are in the early stages of application and should be tracked closely. Oil well surveillance, embedded controllers, and FCEV fuel monitoring are some of the accelerating innovation areas, where adoption has been steadily increasing. Among maturing innovation areas is inspection robots, which is now well established in the industry.

Innovation S-curve for Internet of Things in the oil & gas industry

Worksite network monitoring is a key innovation area in Internet of Things

Worksite monitoring refers to the process of using various sensors and technologies to monitor and collect data related to the conditions and activities at a worksite. The data can then be used for various purposes including safety management, performance optimization, and risk control.

GlobalData’s analysis also uncovers the companies at the forefront of each innovation area and assesses the potential reach and impact of their patenting activity across different applications and geographies. According to GlobalData, there are 80+ companies, spanning technology vendors, established oil & gas companies, and up-and-coming start-ups engaged in the development and application of worksite network monitoring.

Key players in worksite network monitoring – a disruptive innovation in the oil & gas industry

‘Application diversity’ measures the number of applications identified for each patent. It broadly splits companies into either ‘niche’ or ‘diversified’ innovators.

‘Geographic reach’ refers to the number of countries each patent is registered in. It reflects the breadth of geographic application intended, ranging from ‘global’ to ‘local’.

Patent volumes related to worksite network monitoring

| Company | Total patents (2021 - 2023) | Premium intelligence on the world's largest companies |

| China Petrochemical | 71 | Unlock Company Profile |

| China National Petroleum | 69 | Unlock Company Profile |

| NOV | 38 | Unlock Company Profile |

| China National Offshore Oil | 34 | Unlock Company Profile |

| Halliburton | 31 | Unlock Company Profile |

| PPG Industries | 25 | Unlock Company Profile |

| AGC | 23 | Unlock Company Profile |

| SICPA | 19 | Unlock Company Profile |

| BASF | 17 | Unlock Company Profile |

| Baker Hughes | 13 | Unlock Company Profile |

| Komatsu | 11 | Unlock Company Profile |

| Tokyo Gas | 10 | Unlock Company Profile |

| Tyco International | 10 | Unlock Company Profile |

| Shell | 10 | Unlock Company Profile |

| Nippon Sheet Glass | 9 | Unlock Company Profile |

| ENEOS | 9 | Unlock Company Profile |

| Korea Gas | 7 | Unlock Company Profile |

| CNPC Chuanqing Drilling Engineering | 7 | Unlock Company Profile |

| Asahi Kasei | 7 | Unlock Company Profile |

| Emerson Electric | 7 | Unlock Company Profile |

| Toray Industries | 7 | Unlock Company Profile |

| Occidental Petroleum | 6 | Unlock Company Profile |

| Nabors Industries | 5 | Unlock Company Profile |

| Power Construction Corporation of China | 5 | Unlock Company Profile |

| China Energy Investment | 5 | Unlock Company Profile |

| Hydril Usa Manufacturing | 5 | Unlock Company Profile |

| ProFrac | 5 | Unlock Company Profile |

| Koch Industries | 4 | Unlock Company Profile |

| Hitachi | 4 | Unlock Company Profile |

| General Electric | 4 | Unlock Company Profile |

| SitePro | 4 | Unlock Company Profile |

| Ube Industries | 4 | Unlock Company Profile |

| Guangzhou Marine Geological Survey | 3 | Unlock Company Profile |

| Shenhua Ningxia Coal Industry Group | 3 | Unlock Company Profile |

| Metawater | 3 | Unlock Company Profile |

| Resonac | 3 | Unlock Company Profile |

| Sinopec Petroleum Engineering | 3 | Unlock Company Profile |

| Toyota Motor | 3 | Unlock Company Profile |

| ICT | 3 | Unlock Company Profile |

| Chongqing Baojue Machinery Equipment | 2 | Unlock Company Profile |

| Cummins | 2 | Unlock Company Profile |

| DL | 2 | Unlock Company Profile |

| Saudi Arabian Oil | 2 | Unlock Company Profile |

| Vetco Gray | 2 | Unlock Company Profile |

| Zhejiang Energy Group | 2 | Unlock Company Profile |

| Shenzhen Sensetime Technology | 2 | Unlock Company Profile |

| China Petroleum Engineering | 2 | Unlock Company Profile |

| Wuxi Beidouxingtong Information Technology | 2 | Unlock Company Profile |

| China Railway Group | 2 | Unlock Company Profile |

| Ecopetrol | 1 | Unlock Company Profile |

Source: GlobalData Patent Analytics

Sinopec is one of the leading patent filers in worksite network monitoring for the oil & gas industry. The company has a massive operation in the energy sector spanning from oil and gas production, refining, petrochemicals, to renewables. This necessitates efficient management of the workforce to maintain continuity in operations. The company has adopted newer digital technologies such as artificial intelligence (AI), cloud, and the Internet of Things (IoT) to streamline its operations. Some other key patent filers in the space include CNPC and NOV.

In terms of application diversity, Komatsu leads the pack, while Toyota Motor and General Electric stood in the second and third positions, respectively. Komatsu is a prominent equipment and solutions provider for the energy sector. Its product portfolio includes KOMTRAX, a wireless monitoring system, which supports fleet management and preventive maintenance. The company also offers KomVision, a human detection and collision mitigation system, which makes worksite operations more efficient.

By means of geographic reach, Halliburton held the top position, followed by SICPA and PPG. Halliburton offers equipment, sensors, and software solutions for oilfield operations. The company’s flagship software, DecisionSpace 365, allows for agile asset management in the energy sector.

Skilled labor as well as expensive equipment are employed in oil and gas operations. A worksite monitoring solution helps the operators avoid mishaps and loss to life and property, while ensuring operational agility.

To further understand the key themes and technologies disrupting the oil & gas industry, access GlobalData’s latest thematic research report on Internet of Things in Oil & Gas.

Premium Insights

From

The gold standard of business intelligence.

Blending expert knowledge with cutting-edge technology, GlobalData’s unrivalled proprietary data will enable you to decode what’s happening in your market. You can make better informed decisions and gain a future-proof advantage over your competitors.